Dynamic Currency Conversion (DCC) is when a foreign ATM or payment terminal gives you the option to pay in your card’s currency rather than the local currency. In doing so, the payment processor handles the currency conversion instead of your bank.

Travellers “in the know” are well aware you never, ever, under any circumstance, pay in your own currency, because the exchange rate is always abysmal. It’s estimated that Brits lose £1m every day due to DCC. You should always opt to pay in the local currency.

Many people claim DCC is not a scam because the customer is given an option. This is a myth and needs to be dispelled.

Firstly, the service provided by DCC is absolutely unnecessary. Most cards on the Visa/Mastercard network can pay in any currency. Cross-border payments is one of the main problems these networks set out to solve. And in the rare circumstance the card has some kind of currency restriction on it, you wouldn’t be relying on DCC; you just wouldn’t be using the card overseas.

Secondly, DCC leverages ignorance, deception, and urgency, which are all typical hallmarks of a scam. Ignorance, because many people don’t know the exchange rate offered by their bank or why the terminal is even giving them an option. Deception, because the commission is integrated into the rate instead of being displayed separately, and UI is design discourages users from selecting the local currency. And urgency, because the user only has a few seconds to select an option.

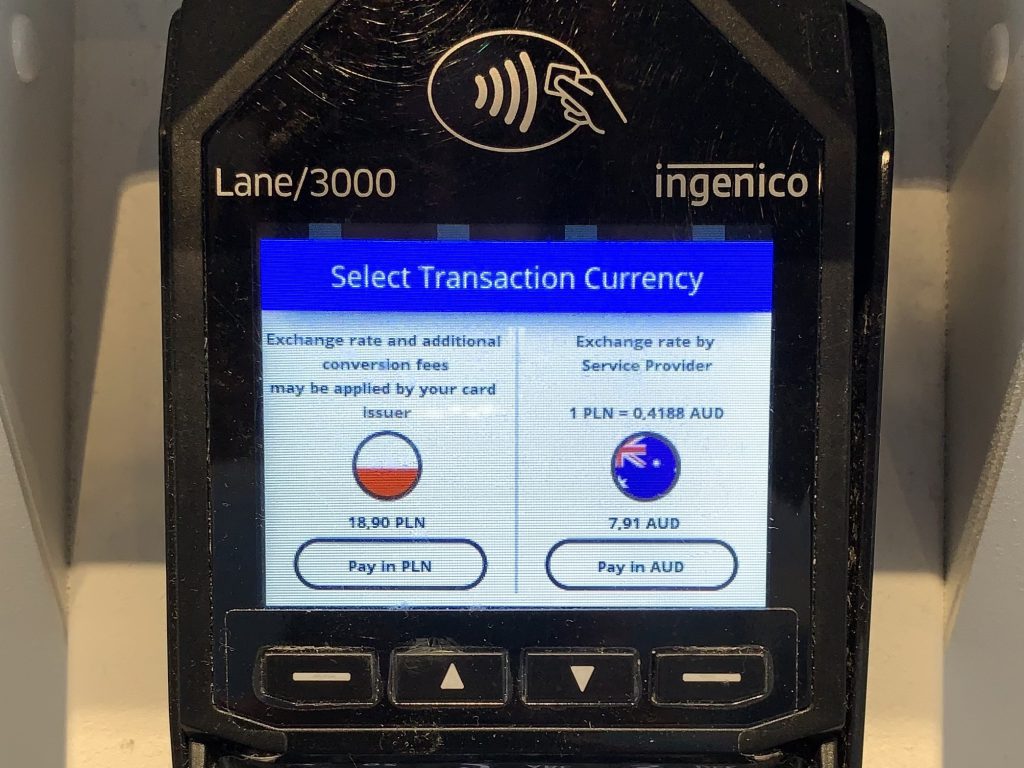

Here’s a PoS in Poland offering DCC on an Australian card. Notice the threat of “additional conversion fees may be applied by your card issuer”, making their rate appear favourable. My bank charged me $7.22 for this transaction, meaning it would have cost me an additional 9.6% if I selected AUD instead of PLN at the terminal.

There was an even worse one which I wasn’t able to capture. It showed a screen similar to above, and after selecting PLN, it showed a confirmation screen which said something to effect of “Guaranteed exchange rate of 1 PLN = 0.4188 AUD. Do you accept? No / Yes”. This is extremely deceptive because you need to press No to pay in the local currency, but your instinct is to press Yes to confirm the option you previously selected. When you only have a few seconds to pick an option, your brain isn’t primed to interpret a negative confirmation.

A predatory process that tricks someone into purchasing a service they didn’t ask for, don’t need, provides no value, adds confusion, and costs up to 12% more than if the service simply wasn’t offered, easily falls into the definition of a scam. And I’d be willing to bet that no modern neobank/digital bank has ever offered a worse rate than DCC.

It doesn’t matter if the user is given an option. All scams involve deceiving someone into performing an action that isn’t in their best interests, that’s what differentiates scams from theft. No one calls pickpocketing a scam.

It blows my mind DCC is allowed to fly, especially in the EU. Someone needs to regulate the heck out of this ASAP.